Do you want to expand your business operations across EU countries? If you need to be sure about international transactions, you must verify VAT numbers frequently. But don’t worry because in this article we will tell you what VAT validation API tools you can utilize to do it in a snap. Continue reading to improve your financial data validation, reach more customers and obtain a bigger revenue!

Let’s start with the most important thing which is knowing what a VAT number refers to. Simply explained, it is a unique identifier used in several countries of the European Union for value-added tax reasons. It allows you to make online money exchanges with any company which is located in Europe and works under EU rules. But, if you enter an inaccurate VAT number, you may encounter problems with your VAT returns later on. That’s why VAT number validation is so important and necessary.

How can my business figure out another company’s VAT? And how can we know if it is valid and correct? Well, you can examine it on your Government’s or at the official EU VAT Information Exchange System (VIES) websites. But there is a better and faster way: creating an account on a VAT validator like an application programming interface (API). These kinds of programs work with more speed than regular sites due to deeper code connections with several servers. So if you introduce the VAT number into the checker, you will find their state (legal or not) and condition (working or invalid) right away.

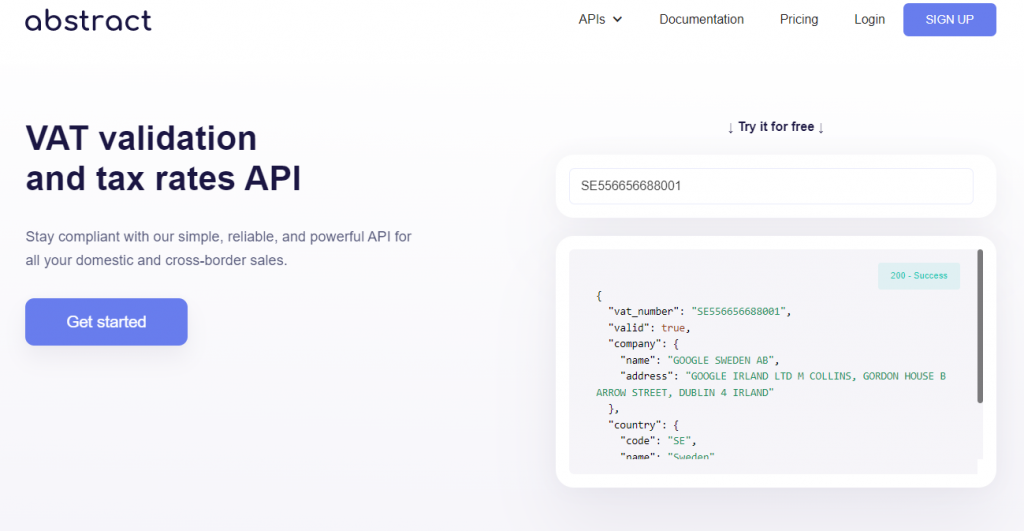

To help you understand this topic, we bring the Abstract API’s case. The platform can automate typical payment processes, including value-added taxes. It authenticates emails, geolocates IP addresses, computes VAT, compresses photos, and many other things. Basically, you provide the information that has to be confirmed and the system returns you if it is right or wrong. You can also get information such as the fiscal issues, the physical address, and the commercial name, among other data. But of course, you can choose another option.

Alternatives For VAT Validation API

VAT Validation API

The best way to tell if a VAT number is valid is to use the VATValidationAPI. It is the best-in-class in security, analytics, and performance. It will give you a quick response, be easy to understand, and be constantly updated! Also, you can learn more about the company if the value-added tax is legitimate.

It compiles all of the EU member states’ country codes. A subscription, an account, and the VAT number you want to check are the only requirements to start! In the case you have the company’s name or the country code but not the VAT, you can still use it to successfully find it.

LOVAT

LOVAT is a great alternative to think about. It’s user-friendly and effective, so anyone on your team can manage taxes. It lets you check your VAT number, calculate the percentages and add the computations to a report page. With this validation tool, you won’t consume a lot of time or resources!

VATSense

VATSense is a VAT number checker API that includes tools for worldwide VAT and GST rates. If you sell your products or services in the UK, for example, you can stay in compliance with VAT thanks to it. Besides, you can not only validate VAT numbers but produce invoices, retrieve EU VAT rates, and convert currencies.