Would you like to learn more about APIs that can help you optimize your business? Read this post to learn more about them and which are the best ones.

The data collection process is a crucial step in almost any project. The data obtained from the process is used to make decisions and take action. It helps you understand your customers better and therefore improve your marketing, sales, and product development initiatives. However, collecting data can be difficult and time-consuming. You might have to use several different tools and applications to get the information you need, which can be both expensive and time-consuming.

Thanks to APIs, all of the daily-use software we use, including social networking, email, and more, has been created. For the development of new processes and procedures, they are crucial. Artificial intelligence is used in conjunction with an Automated Data Capture API. This indicates that the API will deliver precise results in a matter of seconds. It will go through and extract the data from all of the documents you want to study.

One URL is all that is required to use the API. As a result, you won’t need to know any specific details about the system’s user. Additionally, it implies that you won’t require any unique tools or software. All you require is a working internet connection.

Technology like optical character recognition has completely changed how commerce is done. With the use of this technology, texts can be analyzed and turned into digital data. In turn, this enables businesses to store this data in the cloud, automate procedures, lessen human labor, and do much more!

Credit Card OCR API

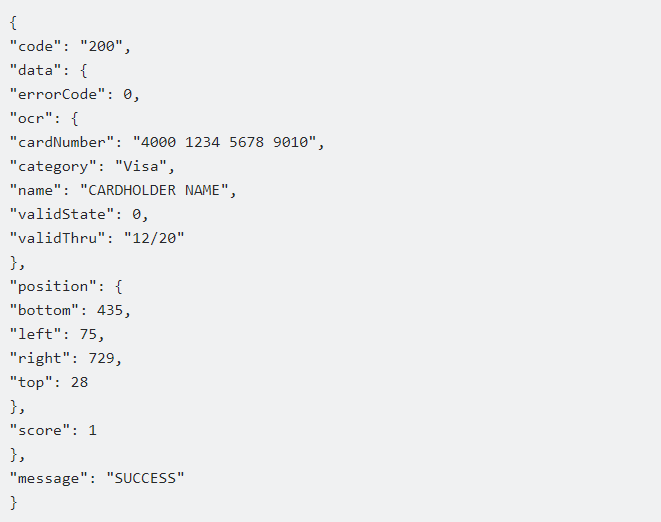

Using optical character recognition (OCR), this API will extract structured data from a screenshot of a credit card. There is no data saved. To capture structured data from the credit card, all that is required is the URL of the public image. You will then receive the necessary information in a response that looks like this:

Payment systems that can recognize credit card images ought to make use of this API. You can obtain the data and do your own validations using this API, such as verifying a credit card’s expiration date.

Before accessing this Credit Card Validation API, online registration is necessary. After logging in, click the “START FREE TRIAL” option. You must select “test endpoint” in order to start the API request after entering the photo URL. The API will immediately reply with all the details you require!

There’s also some alternatives to this API and we are going to talk about them right now:

Helcim

Helcim provides thorough fee disclosures, transparent interchange-plus processing, and no long-term commitments. Additionally, it supports foreign payments and scales effectively with corporate expansion.

Helcim’s developer tools are in the middle of the pack when compared to some of the other services on our list. However, they are more than enough, with a folder-like arrangement and lots of screenshots. Any language that supports API calls is able to use the RESTful Helcim API. Code samples sit just offscreen in an intriguing desktop layout choice and may be dragged on or off the center of your screen with a click.

Authorize.Net

Using Authorize.Net as a payment gateway, you can link your online store to your payment processor, support numerous currencies, add security measures, offer recurring billing services, and enable processing of electronic checks.

It’s possible that Authorize.Net is one of Stripe’s main competitors in terms of developer resources. There is a ton of documentation, including API references, developer manuals, and the Accept Suite, a group of PCI-compliant utilities. The majority of material is accessible to everyone, so you can look it over before deciding. You can test out snippets of code without leaving the resources because a large portion of the documentation includes an API live console.