Did you know that using a Tax Calculator API has many benefits for anyone? These types of services are widely used by users who want to avoid problems with the IRS (Internal Revenue Service). If you are interested and want to know more information about it, then read this post!

Taxes in America play a crucial role in funding public services. Citizens pay taxes based on income and purchases. The federal government collects income tax, while state and local governments impose sales tax. Additionally, property tax supports local services. Tax deductions and credits help lower the tax burden for some. The tax system can be complex and varies across states. It funds essential sectors like education, healthcare, and infrastructure.

Taxes also contribute to social welfare programs, defense, and public safety. However, debates arise over tax rates and the distribution of tax revenue. Policymakers continuously strive to balance tax policies for economic growth and societal needs. Understanding tax obligations empowers individuals to fulfill their civic duties and engage in informed discussions about the country’s financial landscape.

However, calculating taxes is a complicated task. For these reasons you have 2 options, hire an accountant or use an API to do this job. An API is a better option because it is faster and more accurate. We highly recommend using The Taxes API, it is a service created exclusively to calculate taxes.

These Are The Benefits Of Using The Taxes API!

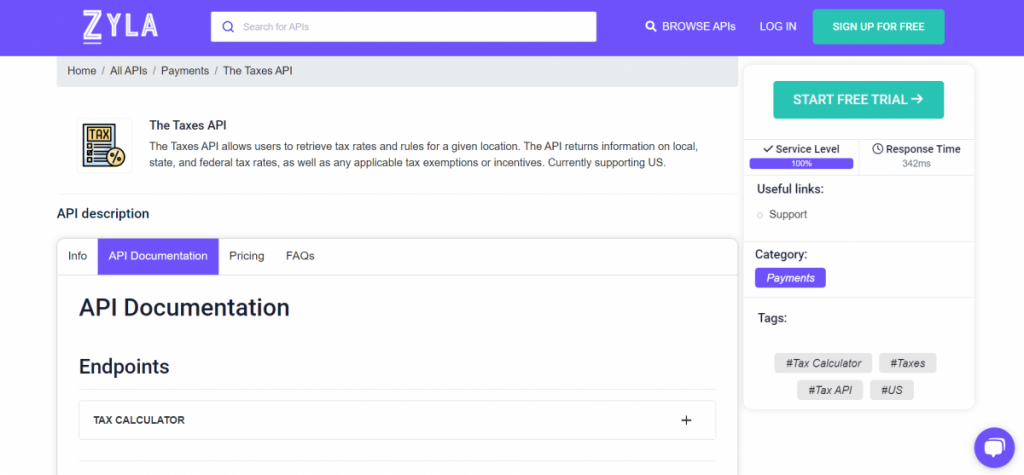

The Taxes API offers a comprehensive solution to simplify tax calculations, reporting, and compliance. With a user-friendly interface and real-time data, this API delivers a multitude of benefits for businesses seeking to optimize their tax processes. One of the primary advantages of The Taxes API is its ability to streamline tax calculations. By tapping into a vast database of up-to-date tax rates and rules, the API ensures accurate results, eliminating the risk of miscalculations.

This accuracy is crucial for businesses as it helps avoid penalties and regulatory issues, allowing companies to focus on growth and development. Also, the tool is a great option for American citizens. Integrating The Taxes API into existing systems is a breeze, thanks to its seamless compatibility. Businesses can effortlessly incorporate the API into their platforms, applications, or websites, saving valuable time and resources on development efforts.

Another advantage of The Taxes API is its ability to scale effortlessly. As businesses grow and expand, the API can accommodate increased tax processing demands without compromising on performance. This scalability makes it an ideal long-term solution for companies looking to future-proof their tax management strategies.

Watch this short video and discover how to use this digital tool:

In conclusion, The Taxes API offers an array of benefits for citizens and businesses seeking to optimize their tax management processes. From accurate calculations and compliance assistance to scalability and data security, the API provides a powerful solution for businesses of all sizes. It’s definitely the best Tax Calculator API.

You can also take a look at this interesting post: What Is Taxes API And How To Use It