In today’s fast-paced financial world, having access to real-time data is crucial for traders. The BEL 20 Price API is a powerful tool designed to provide accurate indices for the Belgian stock market. This API not only offers real-time updates but also enables traders to enhance their strategies and make informed decisions.

How to Use the BEL 20 Price API

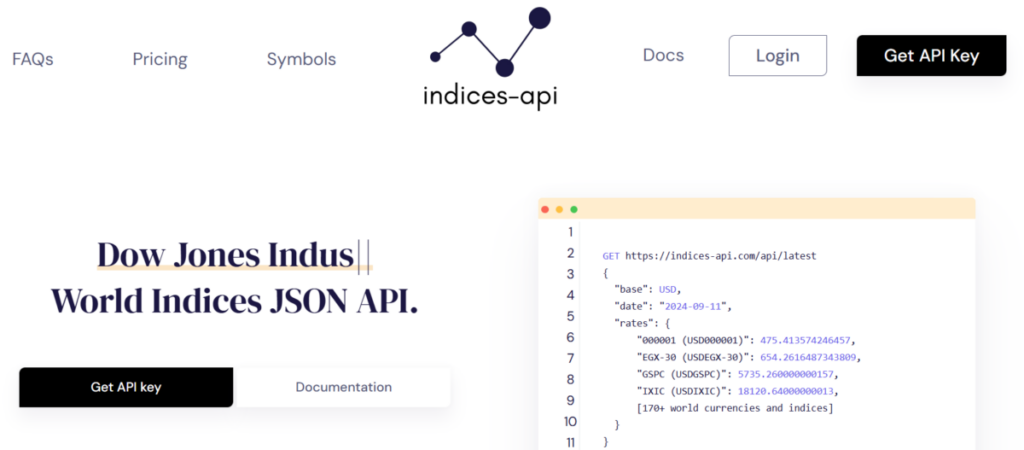

Getting started with the BEL 20 Price API is simple. First, you need to sign up for an account with a provider that offers this API. After signing up, you will receive an API key, which is essential for authentication. With your API key, you can make requests to access real-time data on the BEL 20 index, including current prices, historical data, and market changes.

Once you have your API key, you can integrate it into your trading platform. Most platforms support RESTful API calls, allowing you to fetch data easily. You can choose specific endpoints to get the information you need, whether it’s the latest price, percentage change, or market volume. This seamless integration enables you to monitor the market effectively and react swiftly to any changes.

The Importance of Real-Time Market Data for Traders

Real-time market data is the backbone of effective trading strategies. For traders, timing is everything. Being able to access up-to-date information allows them to make quick decisions, capitalize on market movements, and mitigate risks. The BEL 20 Price API delivers essential data without delays, ensuring traders have the latest information at their fingertips.

Market trends can change rapidly, and having access to real-time updates can mean the difference between a profitable trade and a loss. By utilizing the BEL 20 Price API , traders can track the performance of the BEL 20 index and identify patterns that might indicate future movements. This kind of analysis is crucial for developing effective trading strategies.

Benefits of the Indices API

The Indices API complements the BEL 20 Price API by offering a broader range of financial indices beyond just the BEL 20. It provides comprehensive data that helps traders analyze market conditions more thoroughly. With features like historical data access, live updates, and analytics tools, the Indices API is an invaluable resource.

One of the significant benefits of using the Indices API is its ability to provide accurate and up-to-date information on various market indices. This feature allows traders to compare the BEL 20 with other indices, helping them understand broader market trends and make more informed decisions.

Additionally, the Indices API offers user-friendly documentation and support, making it easy for both novice and experienced traders to integrate it into their systems. This accessibility ensures that traders can leverage the full potential of the API without any technical hurdles.

Enhanced Trading Strategies with Accurate Indices

By using the BEL 20 Price API and the Indices API, traders can enhance their trading strategies significantly. Real-time data allows for better market analysis, which leads to more precise predictions. Traders can set alerts based on specific market conditions, helping them react promptly to changes.

Moreover, the data provided by these APIs can be used to backtest strategies. Traders can analyze historical performance and fine-tune their approaches based on past data. This analytical capability is crucial for building robust trading strategies that withstand market fluctuations.

Conclusion

The BEL 20 Price API is an essential tool for anyone involved in trading on the Belgian stock market. By providing real-time data and comprehensive insights, it empowers traders to make informed decisions. Coupled with the Indices API, users gain a competitive edge through enhanced market analysis and strategy development. In an environment where every second counts, the importance of real-time market data cannot be overstated.