Do you want to start investing in precious metals but don’t know how? Here we bring you a guide where you will learn the best tips and how to use a precious metals API!

Precious metals are regarded to be an excellent portfolio diversifier and inflation hedge; however, gold, the most well-known of these metals, is not the only one available to investors. Silver, platinum, and palladium are all precious metals that may be added to your portfolio, and each has its own set of risks and rewards.

Investors can acquire access to actual metal through the futures market, metal ETFs and mutual funds, and mining company equities, in addition to owning real metal. Let’s look at some of the best metals to invest in:

- Gold: Let’s begin with the granddaddy of all precious metals: gold. Gold is distinguished by its resistance to rust and corrosion, malleability, and ability to carry both heat and electricity. It has certain industrial uses in dentistry and electronics, but it is best known as a jewelry basis and a type of cash.

- Silver: the price of this metal fluctuates between its perceived position as a store of value and its role as an industrial metal, unlike gold’s. As a result, price swings in the silver market are more volatile than those in the gold market. The metal’s price is influenced by the industrial supply/demand equation in a similar way.

- Platinum: traded on global commodities markets around the clock, much like gold and silver. Because it is significantly rarer, it frequently fetches a greater price (per troy ounce) than gold during normal periods of market and political stability. Annually, far less metal is actually extracted from the earth.

- Palladium: less well-known metal with more industrial applications than the other three metals. Palladium is a gleaming, silvery metal that is employed in a variety of production processes, including electronics and industrial items. It’s also utilized in dentistry, medical, chemical applications, jewelry, and groundwater remediation, among other things.

Precious metals provide unique inflationary protection due to their inherent worth, lack of credit risk, and inability to be inflated. That implies you won’t be able to print any longer. They also provide true “upheaval insurance” for financial and political/military disruptions. As a result, we suggest the Metals-API, a platform that allows you to exchange data on precious metal prices and currencies.

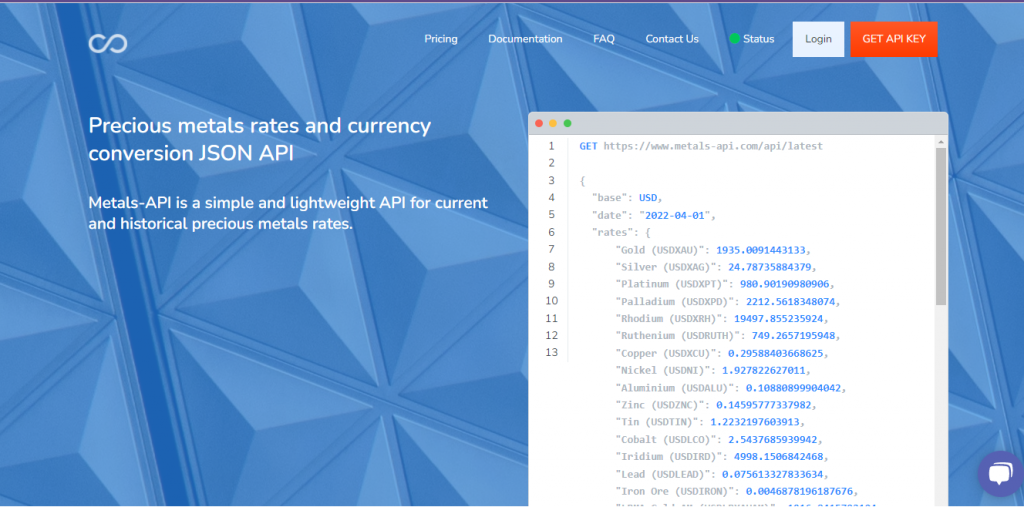

An Overview About Metals-API

Metals-API collects market data prices in a number of forms and frequency from a variety of trade sources and organizations throughout the world. Commercial sources are also suggested, especially for major currencies and commodities, because they provide a more accurate depiction of market exchange values.

A Site Easy To Use

This platform is unique in that it is really simple to use. To do this, you must complete the following steps:

– Sign up for a Metals-API account.

– Choose the metals and currencies that best match your criteria.

– Send an API request to the website, specifying the metals and base currency you wish to use in the symbol and base currency fields, respectively.

Safest Platform In The Web

Currency data is obtained through Metals-API from financial data suppliers and institutions, such as the European Central Bank. Because it is secured with bank-grade 256-bit SSL encryption, the connection is secure to the level of a bank.