The digitization of the banking sector has led to an increased pace of financial transactions. Additionally, this dynamic environment brings up the challenge of having real-time data. Access to accurate financial data is essential to make informed decisions. A Bank Routing Number Verification API is a powerful tool for quick and easy access to financial data. It simplifies the process of verifying bank routing numbers, preventing fraud and errors. Additionally, it facilitates the setup of direct deposit and other financial services.

There are several different bank routing number verification APIs available, each with its strengths and weaknesses. Some APIs offer more comprehensive data than others, while others are more affordable. It is important to carefully compare the different options before choosing an API for your needs.

Power Of A Bank Lookup API: Effortless Financial DATA Access

When selecting a Banking lookup API provider, you must consider these important factors

- Cost: Evaluate the pricing structure to ensure it aligns with your project budget.

- Accuracy: Seek an API provider that offers reliable and precise data verification to prevent costly errors.

- Speed: Assess the API’s response time to ensure efficient data retrieval for your application.

- Features: Evaluate the range of features and functionalities provided by the API to meet your specific requirements.

- Support: Choose an API provider that offers comprehensive customer support to address any issues or concerns.

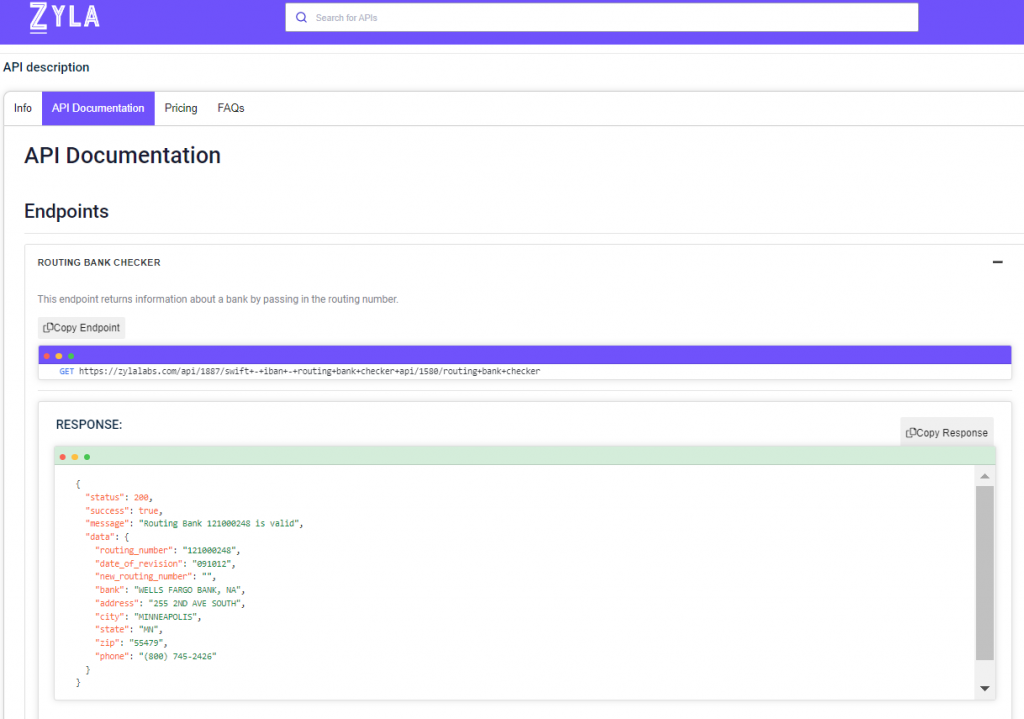

Among the various bank lookup APIs available, the SWIFT – IBAN – Routing Bank Checker API is a standout choice due to its high effectiveness and user-friendly interface. You can find this acclaimed API on the Zyla API Hub, a trusted marketplace known for its reliable APIs.

To explore the API, visit www.zylalabs.com and navigate to the Categories menu. Select the category Payments. As you will land on the Best Payments APIs page featuring this API. Click on the API to access its dedicated page, where you will find detailed information and documentation, including a list of available endpoints.

To begin your journey, take advantage of the free 7-day trial, allowing you to experience the API’s functionality firsthand. During this trial period, you can evaluate its effectiveness and suitability for your project.

Unsung Features Of The Bank Lookup API.

This banking information API offers comprehensive solutions when it comes to transactions around the globe. Whether it is effortlessly accessing critical information regarding SWIFT codes, IBAN codes, and Routing Bank Numbers. This Bank Routing Number Verification API is designed to ensure efficient verification of banking information, enabling the streamlining of international financial transactions.

Authenticating SWIFT Codes.

One of the noteworthy features of the Banking Information API is its ability to authenticate SWIFT codes. Which serve as unique identifiers for facilitating international transactions. The accuracy of these codes is of paramount importance in guaranteeing the correct transfer of funds to the intended recipient. With the Bank Codes Lookup API, users can quickly verify the validity of SWIFT codes. Ensuring consistent and accurate direction of funds to the correct destination.

Verify IBAN Codes.

In addition to validating SWIFT codes, it also allows users to verify IBAN codes. Used by countries in Europe and other regions to identify bank accounts in international transfers. Utilizing the Bank Codes Lookup API, the accuracy of an IBAN code can be verified promptly. Thereby minimizing the risk of errors in financial transactions.

Confirming Accuracy Of Routing Bank Number.

The Bank Codes Lookup API swiftly confirms the accuracy of Routing Bank Numbers which serve as a crucial element in financial transactions. In the United States, financial institutions employ Routing Bank Numbers to identify and process transactions. Utilizing this API to validate Routing Bank Numbers reduces the likelihood of errors and ensures prompt and accurate transaction processing.

Easy To Integrate Into Existing Financial Systems.

The Bank Codes Lookup API has been developed for easy integration into existing financial systems, enabling users to effortlessly retrieve information on SWIFT codes, and IBAN codes, and Routing Bank Numbers through simple API requests. Its scalability renders it suitable for use by both large financial institutions and small businesses alike, allowing a wide range of users to benefit from its features.

Getting Started.

To start using SWIFT – IBAN – Routing Bank Checker API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you can start your free trial. You can send API requests using different endpoints based on your interest. Once you select your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

Routing Number (INPUT) – 121000248

Below is the API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}