The commodities market is a constantly changing environment where traders and investors look for chances to make big profits. We will go into the intriguing world of Live Cattle Aug 2024 in this trading insights guide, examining its appeal, navigating the complex world of livestock commodities, and laying out our expectations for what this book contains.

In the cutthroat agriculture sector of today, being one step ahead of the curve is essential to success. Investors, traders, and other participants must all comprehend the subtleties of the live cattle market. This blog post will serve as your go-to source for information on the live cattle market, its trends, and practical advice on navigating this difficult industry.

Why You Should Invest in Live Cattle Aug 2024 Futures

The live cattle market offers significant profit potential in addition to risk management. Examine the potential for making money on investments in live cattle. Cattle prices are influenced by geopolitical and economic factors that extend beyond the pastures. Examine the effects of tariffs, trade laws, and world events on the market.

Live cattle are essential to the agricultural sector because they support the larger farming ecology in addition to helping to produce meat. When their significance is fully understood, the relationship between live cattle and agriculture becomes clear. These contracts, which are agreements to purchase or sell live cattle at a later time, form the foundation of the market for live cattle investments. Deciphering their objective is essential to unleashing this market’s potential.

In summary, the Live Cattle Aug 2024 market is a dynamic environment with a plethora of prospects for those who are knowledgeable about its nuances. It is more than just statistics and contracts. In this field, successful outcomes can be achieved by remaining informed, taking reasonable risks, and employing the appropriate tools. As you go out on this adventure, remember that the profitability of this market is a direct result of your timing, strategy, and level of understanding.

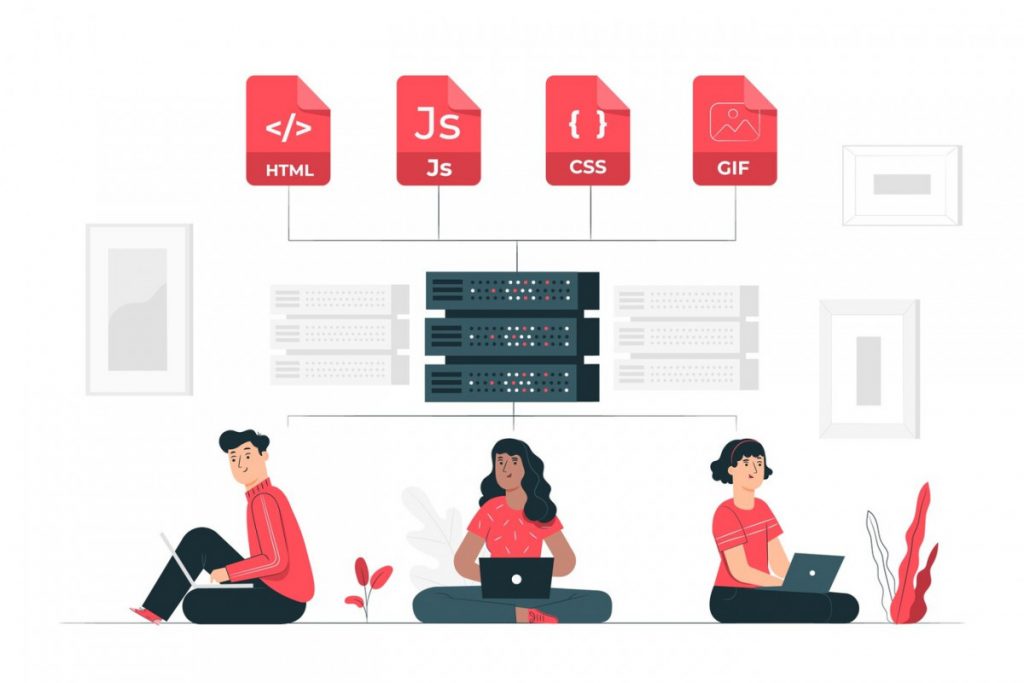

Commodities API

Commodities-API was once an Open-Source, lightweight, straightforward API for obtaining historical and present commodity rates from bank and stock market sources. Up to once every sixty seconds, the API can provide real-time commodity data with two decimal places of accuracy. Delivering exchange rates for practically any commodity, converting precious metals, retrieving time-series data, and offering volatility statistics are a few of the features.

This documentation provides information on the API’s structure, potential problems, and code samples. Get in touch with their support team if you have any additional questions; they will be pleased to assist you.

You can access a plethora of information by just passing one of the five primary API Endpoints your unique Access Key as a query argument. An example of the kind of answer you would get from the “Latest Rates” endpoint is as follows:

{"data":{"success":true,"timestamp":1698432120,"date":"2023-10-27","base":"USD","rates":{"LCQ24":0.0055959709009513},"unit":{}}}

You must first register on the website in order to use this API. Choose “START FREE TRIAL” from the menu to get started. Currently, API calls are necessary. You will receive a file containing the required data in one or more formats once your inputs have been processed.

The API is used daily by thousands of developers, numerous SMBs, and large corporations. Thanks to its reliable data sources and over six years of experience, this API is the best place to learn about commodity pricing. The World Bank, other organizations, and providers of financial data are the sources of the commodities data that the API offers.