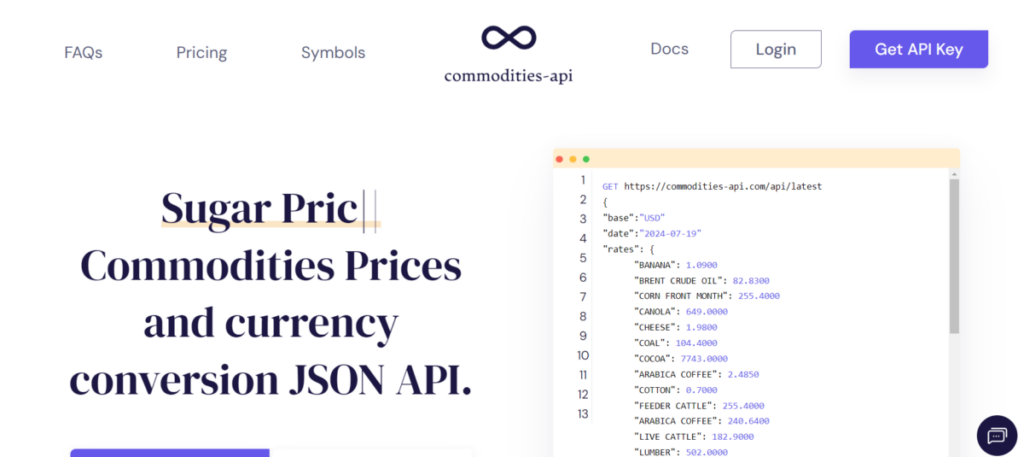

In today’s fast-paced digital world, access to real-time data is crucial for businesses and developers working in commodity markets. Commodities-API offers a robust solution for obtaining comprehensive pricing data on various commodities, with a special focus on the Apple Rates API. This API is a game-changer for developers looking to integrate accurate and timely data into their applications.

What is Commodities-API? Best Apple Rates API

Commodities-API is a powerful tool designed to provide real-time and historical pricing data for a wide range of commodities. It offers a seamless interface that developers can use to access up-to-date market information. The API is particularly beneficial for those interested in commodities like apples, among many others. By integrating this API into your system, you can pull accurate data on commodity prices, trends, and historical comparisons with ease.

One of the standout features of the Commodities-API is its comprehensive Apple Rates API. This specific API is dedicated to providing detailed information about apple prices, which can be crucial for various applications, from trading algorithms to market analysis tools.

Key Features of the Apple Rates API

Real-Time Data: The API offers up-to-the-minute pricing information. This real-time data is essential for applications that require the latest market trends to make informed decisions.

Historical Data: In addition to current prices, the API provides historical data on apple rates. This feature is valuable for analyzing price trends over time. For example, you can compare current apple prices with those from previous years to identify patterns or seasonal fluctuations.

Data Accuracy: The API ensures high accuracy in its data, which is crucial for financial analysis and trading applications. Accurate data helps in making precise predictions and decisions.

Ease of Integration: With its user-friendly interface, the Apple Rates API integrates seamlessly into various applications. Developers can quickly incorporate this data into their systems without extensive coding or setup.

Practical Applications

Integrate real-time and historical apple price data to provide users with insights into market trends. For instance, if the current apple price is $3.50 per kilogram and the historical data shows a price range between $2.80 and $3.60 over the past five years, your tool can offer valuable analysis on price stability and volatility. Use the API to develop trading algorithms that respond to price changes in real time. If there’s a significant drop or rise in apple prices, your trading system can execute trades or adjust strategies accordingly.

Provide consumers with up-to-date pricing information on apples. For instance, if recent data shows a sharp increase in prices due to poor harvest conditions, consumers can make informed purchasing decisions.

Getting Started with Apple Rates API

To get started with the Commodities-API, follow these simple steps:

Sign Up: Register on the Commodities-API website to get your API key. This key will grant you access to the data you need.

Integration: Incorporate the API into your application using the provided documentation. The API offers various endpoints to fetch current and historical apple prices.

Customization: Customize the data retrieval according to your needs. You can specify parameters like date ranges or price types.

Testing: Test the integration thoroughly to ensure that the data is accurate and the API performs as expected.

Launch: Once testing is complete, launch your application with the integrated Apple Rates API.

Conclusion

The Commodities-API, with its specialized Apple Rates API, provides developers with a powerful tool for accessing real-time and historical Apple pricing data. By incorporating this API into your projects, you can enhance your applications with accurate and timely information, making them more valuable to users and more effective in decision-making. With its ease of integration and comprehensive data offerings, the Apple Rates API is an indispensable resource for anyone working in the commodity markets.