Are you looking for a way to get accurate spot prices in the commodity market? Then this is article is ertainly for you! Continue reading below and learn all there is to know about APIs for commodities!

If you trade commodities, such as oil, wheat, or lumber, you’ve probably heard of spot prices. A spot price is the price you will pay to acquire any asset immediately. Including securities, commodities, among others. A commodity is a tangible item that may be purchased or sold on a commodities exchange.

Commodities are divided into two types: hard and soft. Hard commodities are frequently mined or extracted. While soft commodities often include agricultural items such as coffee and maize. Commodities are traded on two markets: the spot market (for immediate delivery) and the futures market (for future delivery).

In commodity trading, the seller enters into a legal agreement to supply an agreed-upon quantity of the commodity on a specific day at a specified price. The spot price (the current price) is an important consideration in deciding how futures contracts are valued.

For example, say a barrel of crude oil is trading at $68 one day. However, its one-year futures contract was valued at $64 per barrel, indicating that the market expected oil prices to fall. The spot price of crude oil on that day would be $68, and the contract price, which is dependent in part on the spot price, would be $64.

How Can An API For Commodities Prices Help?

Commodity traders utilize futures contracts for two main reasons. Either to hedge against rises or declines in spot price, or to bet on whether the spot price of a commodity will increase or drop.

When the spot price of a commodity is less than the futures price, the market is said to be in “contango.” The market is in “backwardation” when the spot price is greater than the futures price. As the contract nears its expiration, spot and futures prices tend to converge.

For investors, forecasting fluctuations in spot prices can be difficult. Weather, political instability, and labor strikes are just a few of the many factors that can influence commodity prices.

Individual investors looking to diversify their portfolios with commodities may find that investing in an API that tracks a major commodity index is a less risky choice than investing directly. For this reason, we highly recommend one such as Commodities-API that can meet those expectations.

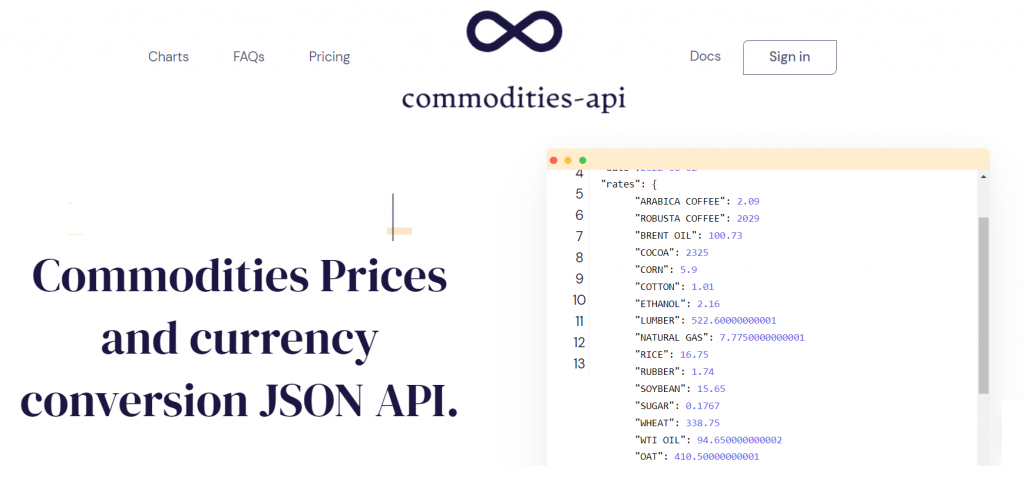

Why Commodities-API?

Commodities-API is a portal that offers compensated market statistics on a variety of commodities, including coffee, cereal, and oils. Customers can purchase them using an API, which can be set up in under a minute after contacting participating banks. To facilitate use, the site includes API documentation.

This API has become one of the top solutions for business owners and developers because to its user-friendly features and accurate data. It may choose from over 170 different coinage and obtain data with a precision of two decimal points. You can submit up to 100,000 API requests each month and receive data updates every 60 seconds, depending on the bundle you choose.

Commodities-API is one of the most useful JSON APIs currently available on the Internet due to the years of experience. This tool collects data from over fifteen trustworthy sources, including international banks, financial institutions, and brokers. As a result, it provides the most updated market data!

There is no software to download, all you need is a computer and an internet connection! Now that you know everything about APIs for commodities spot prices, try this one out to get reliable data!