The global markets are influenced by the vital pulse of Gold Price Today Madurai, which is the dynamic rhythmic dance of the financial environment. This piece takes readers on a tour of the world of real-time gold price data and examines its importance for businesses, investors, and decision-making. Gold prices show up as a vital thread in the intricate fabric of financial markets. Due to the transient nature of these values, timely information is essential for making well-informed judgments and strategic movements in the given environment.

The financial landscape has undergone a transformative shift with the evolution of Application Programming Interfaces (APIs). Traditionally, accessing real-time data posed challenges, but APIs have emerged as game-changers, providing seamless gateways to a wealth of information.

The Dynamic World of Gold Price Today Madurai

APIs are changing the financial environment; they are the foundation of that change. Real-time data access and utilization are undergoing a revolution, moving away from antiquated techniques and toward modern API-driven solutions. APIs and gold prices are entwined in a mutually beneficial connection. APIs are like doors, opening up a wealth of real-time gold price data. For users in Madurai, their simplicity of integration and accessibility make them important tools.

Choosing the appropriate API is essential to utilizing real-time gold price information. Users are guided through the wide API environment by criteria like data correctness, reliability, and real-time updates. These criteria serve as a compass.

Even though gold is frequently seen as a stable and prosperous symbol, it is always fluctuating due to a wide range of reasons. It is not just a strategic benefit, but also a requirement to stay up to date with real-time gold prices, from global economic trends to local market dynamics. APIs serve as virtual gatekeepers, providing consumers with unparalleled ease of access to real-time gold price information. Their mission goes beyond providing accessibility; it also involves transforming how companies and investors use and engage with data related to the gold market.

Metals-API

An open-source, lightweight, and simple API, the first iteration of Metals-API provided historical and current values for the precious metals held by banks. With a precision of two decimal places and a frequency of up to sixty seconds, the Metals-API offers real-time precious metals data. A few of the functions include getting time-series and fluctuation data, converting single currencies, finding the lowest and highest price of the day, and providing exchange rates for precious metals.

Thousands of developers, SMBs, and large corporations utilize it daily. With more than six years of experience and trustworthy data sources, the API is the greatest place to find metals rates. Metals-API obtains its currency data from a number of banks and financial data providers, including the European Central Bank.

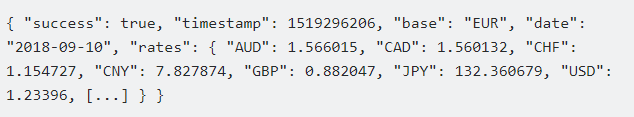

To continue, you must first register on our page. Next, create an API request by adding the desired metals and your preferred currency to the base currency, utilizing the symbols that match your search. The following is an example of an API response:

The Metals-API provides exchange rates against the US dollar by default. Since the data is all returned in the same JSON format, parsing it in any computer language is easy.

When receiving metal rates with USD selected as the base currency (using the ‘base’ option, which defaults to USD if not specified), the API response must have 1/value appended. For example, run 1/0.0004831705 to find the gold rate in USD based on the API response result; the result is 2069.6627795 USD. If USD is the base, the price in USD will be given in the API response; no further conversion is required.

To find this, for instance, using USDXAU (ONLY APPLIES FOR LATEST ENDPOINT). It’s also crucial to keep in mind that if you decide to use a different base currency, such as EUR, the 1/value split is not necessary. Already, the price has been changed.