Are you looking for an API solution to help you detect fraudulent transactions? You’ve come to the right place!

Let’s start by saying that there are many different types of fraud detection APIs on the market, each with its own strengths and weaknesses. Fraud detection is the process of identifying and stopping fraudulent activity before it causes damage to a business or individual. It involves monitoring transactions and activities for signs of fraud, and taking action when suspicious activity is detected. Fraud detection can be a manual process or it can be automated using software. Automated fraud detection systems use data analytics to identify suspicious activity and alert human monitors to potential fraud.

There are many ways to prevent fraudulent transactions with an API. One way is to use a Payment Gateway Integration API to verify the authenticity of each transaction before it is processed. This can help to ensure that only legitimate transactions are processed. Another way is to use an API to monitor activity in real-time and identify any suspicious activity. This can help to catch fraudulent transactions before they are processed.

Overall, an API can provide a valuable layer of protection against fraudulent transactions. However, it should be used in conjunction with other security measures to provide the best protection.

Furthermore, both novices and experts may utilize these tools because of how user-friendly they are. Your e-commerce website should authenticate BINs using the appropriate API to guarantee secure payments. If you don’t do this, you can end up accepting faulty cards, which could cost your company money. They are quite intuitive and have great usability, which is why. If you want to start using one of these, we suggest using this tool.

BIN IP Checker

This API has been made especially for webmasters who want to closely examine credit/debit card transactions that take place on their websites. It provides a clear illustration of how hazardous the trades are. With their own set of limitations, anyone is free to utilize this API anyway they see fit on any platform.

What uses are made of this API? In order to obtain as much information as possible, the user will enter their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number). Additionally, it will return information on the IP address if the request includes one, match the BIN information to the IP information, and calculate the transaction risk score. Online stores benefit from assisting customers in making informed decisions.

You must first register in order to use the BIN IP Checker API. Click “START FREE TRIAL” to begin the risk-free trial. You may then start executing API queries after that. After entering the BIN number, choose “test endpoint” to dial the endpoint. The response will contain all relevant information about that number. Now that you know how to utilize it, you can use it for development!

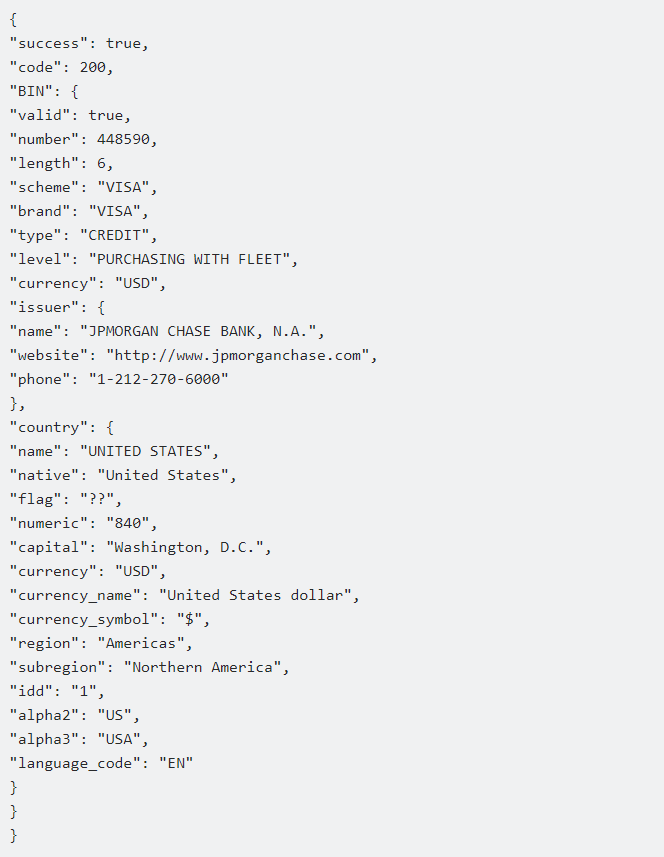

The first six to eleven digits of each credit card are known as the card BIN, and this endpoint will validate these while also returning a complete JSON response. By using this API, you can stop fraudulent transactions from costing you money. This API will respond to your call with a response that looks somewhat like this:

The user will receive all of the BIN’s details if they merely supply the BIN number. The system will return the whole data of the BIN and the IP address together with a risk score if the user sends both the BIN and the IP address of his client.