The price of gold is generally stable and secure, but like any other commodity, it is subject to fluctuations. It is important for investors to be aware of the current price of gold and the factors that can influence its price movements. This can be done with the help of an API and we will tell you about it in this article!

Like other markets, the price of gold is determined by the law of supply and demand. This means that it depends on two factors: the volume of gold being produced at any given time, and the level of investor interest in the metal. If there is a limited supply of gold and increasing investor demand, the price of gold will tend to rise, unless other factors impact the market in the opposite direction.

Gold is often seen as a safe investment option in times of economic uncertainty or a downward outlook. When the world’s major economic powers have a negative outlook, due to crises or market fluctuations, gold tends to increase in value. Its reputation as a safe-haven asset is well-deserved, as it allows investors to protect a portion of their wealth through gold ownership, with the potential for future returns. During times of economic turmoil, many investors turn to gold as a hedge against market instability.

The value of a gold ounce is typically measured in relation to the U.S. dollar. The relationship between the two is typically inversely proportional, meaning that when the value of the dollar is strong, the price of gold tends to be lower, and when the dollar weakens, the price of gold tends to rise.

Gold also has practical uses, particularly in the jewelry industry. When the demand for gold in the jewelry sector increases, the price of gold tends to rise as well. The demand for jewelry can be influenced by a variety of factors, including consumer purchasing power and trends in the fashion industry. When there is an increase in the demand for jewelry products, it can indicate that society has greater purchasing power, which can contribute to an increase in the price of gold.

Use An API To Know The Daily Price Of Gold

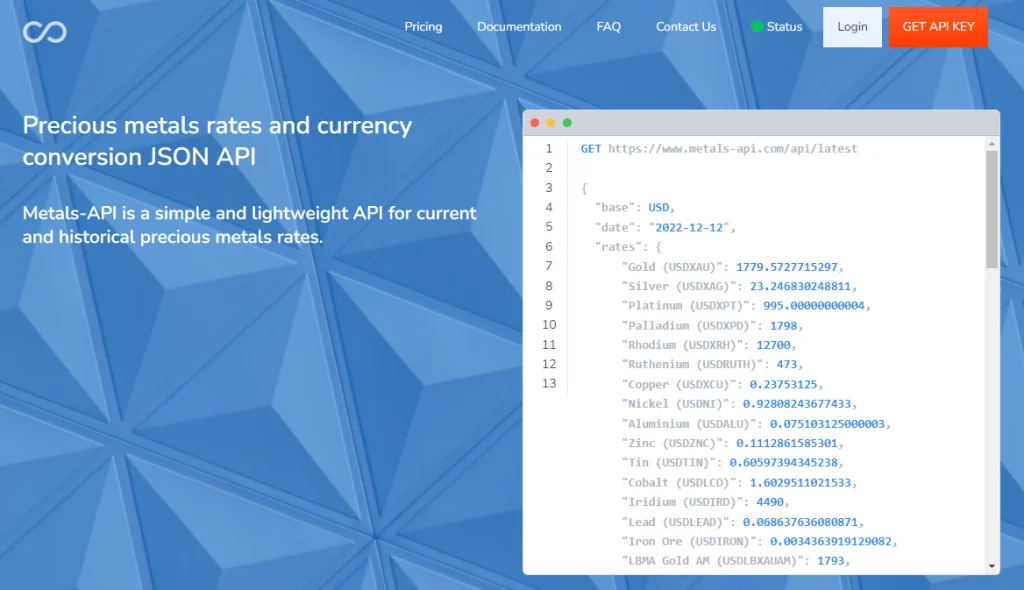

There are a variety of factors that can impact the price of gold and other metals, and many businesses and organizations rely on this information to manage their operations and investments. To stay informed about the current market value of gold, companies can use APIs like Metals-API, which provide real-time access to global financial markets and offer accurate gold pricing.

This tool allows businesses to stay updated on the latest market trends and make informed decisions on a daily basis. By integrating Metals-API into their platforms, businesses can easily access up-to-date market information and make strategic decisions based on accurate gold prices. Among the many available Precious Metals APIs in the market, we suggest you take a look at MetalsAPI.

More About MetalsAPI

If you are looking for an API that provides reliable information about the global metals market, Metals-API is a great option. It is widely used by programmers due to its easy-to-use interface and compatibility with various programming languages like JSON, PHP, and Python. With this API, you can access data from leading financial markets such as the World Bank or LBMA.

By integrating Metals-API into your business, you can access real-time or historical information and analyze it using various options. For example, you can compare data from different dates or choose the currency in which values are expressed. This API is a valuable tool that can save you time and improve your business operations. Don’t hesitate to integrate it into your business today!