Do you want to add this VAT Validator API to your company? keep reading to learn more.

As a shopper, I’m sure everyone is aware of and at least somewhat knowledgeable about value-added tax (VAT). Nevertheless, if you own a company, you need to learn more about VAT than just how much extra money you have to spend per week. Your firm’s ability to function lawfully may depend on how it manages VAT.

VAT is a kind of value-added tax that is levied on the acquisition of items or services as well as other chargeable supplies. It is important to businesses because it may be applied to many different products and services. VAT for charity is governed by various laws.

Nevertheless, most firms have to pay taxes on the selling of their goods and/or services, the leasing or lending of their stock, incentives, product swaps, sales to workers, the acquisition of company property for individual use, and the sale of business assets.

You must add VAT to any goods or services you offer if your business is registered for VAT. Any things you purchase for your business may potentially be eligible for a VAT refund. Taking into account the total value of the things you sell, your business’s VAT is calculated.

VAT must be applied to sales, even if you operate on an exchange or part-exchange basis. Although if you pay a customer a rate that excludes VAT, they will still perceive that cost along with VAT.

Certain goods and services may not be subject to VAT in certain countries. A few examples include the leasing or selling of commercial real estate, the provision of banking and insurance services, or the purchase of postage stamps.

Use An API

Application Programming Interfaces (APIs) are building blocks found in programming languages that enable programmers to easily design complicated features. They give a more approachable syntax by abstracting away more intricate code. Major browsers offer a sizable number of APIs that let you accomplish a wide range of things in your code.

What do APIs have to do with VAT taxes? Well, companies have a lot of VAT numbers to validate and show their transparency in paying taxes. But having to check the numbers one by one can be a tedious task that wastes a lot of time and money.

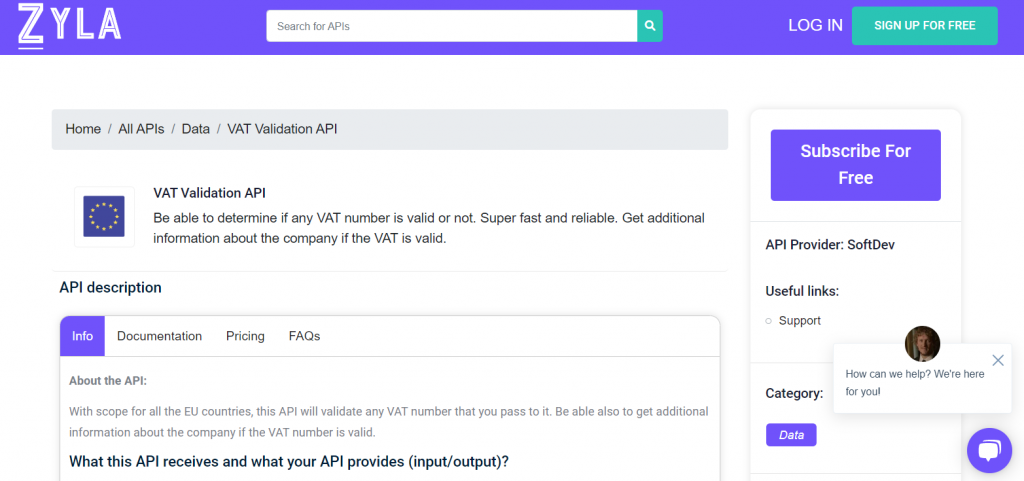

The idea of APIs is that you can automate this task, speeding up the work and reducing the margin of error. You can do all this with the VAT Validation API that works in several programming languages.

About VAT VAlidation API

VAT Validation API is the new technology used by companies that want to demonstrate the correct payment of their taxes. This API allows transparency towards the state authorities but also towards the audiences of each company, since they expect it to be a reliable company.

Furthermore, they expect the correct payment of their taxes as any citizen is part of that. This API is very easy to integrate into your digital media. In addition to the verification of the number, if it is correct, it will inform the name of the company and its location.