Do you want to get multiple metal prices in multiple currencies at once? You should try using an API! In this post, we explain some elements to bear in mind about the metal worldwide market and recommend a special API to afford this trade.

The London Metal Exchange indicator has dropped 23% since the end of March, albeit the decrease has been exaggerated because prices skyrocketed that month in response to Russia’s attack on Ukraine. Tin has dropped 39%, while aluminum has fallen around a third, and copper has dropped nearly a fifth. It will be the index’s first quarterly decline since the outbreak began.

The possibility of a recession in the United States, and maybe internationally, looms over the market. At the very least, the main countries are on the verge of a downturn, which would reduce infrastructure projects, which require numerous metals such as steel.

In this regard, the price of copper, the essential metal for the electrical and technology industries, fell to a 17-month low, continuing the drop of the previous quarter. This is due to rising concerns about a worldwide global recession, which is causing a drop in bulk products.

In London, this metal, seen as a bellwether of the world economy, plummeted as much as 3.7% to $7,955 per metric ton. In the three months ended June 30, prices fell 20%, the lowest quarter in a decade. Aluminum, nickel, and zinc all prolonged declines as the LME’s index of six basic metals reported its largest quarterly decrease since the 2008 global financial crisis.

Metals are seeing some high points as Chinese demand (the world’s largest gold importer) slowly returns from Covid-related lockdowns and the government pumps up assistance, such as more money for infrastructure projects. The overall housing market downturn slowed in June, while industrial production rebounded more quickly than projected.

Use An API

As you can see, the metals market is very varied due to the different objects it comprises. On the other hand, it is interesting to observe the globalization of the market, since no matter where in the world you are, you must pay attention to the dynamics of the market in other countries. This will give you a better overview to better understand how the market works and be more daring when it comes to participating in it.

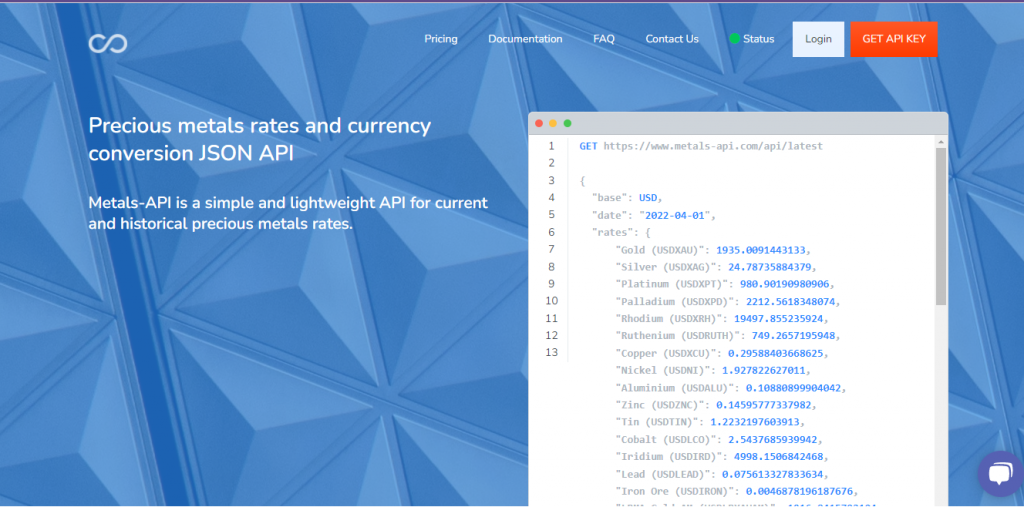

For this reason, you should use an API that transfers all kinds of information about the metals market so that you can select the one you want to focus on. In this sense, there are many online APIs, but in general, they only transmit the prices in dollars, euros, or Japanese yen.

And as we mentioned before, you need to be able to see how metal prices fluctuate in various economies around the world. To view metal prices in multiple currencies at once, you must use the Metals-API. As well as having over 170 currency options, you can look at all of those prices at once.

Why Metals-API?

Metals-API is the most complete in terms of metal products and currencies. You will be able to observe the most important markets in the world, that is why it is an LBMA rates API. You will be able to observe current, historical prices, and futures contracts with it. This way you can become much more expert in the metals market.