Are you trying to find a trustworthy API that makes managing bank accounts easier? Are you looking for a transaction-supporting API? Continue reading this article after that.

The financial services industry is evolving. A digital transformation strategy has been developed by every successful bank in response to the demanding online and mobile services from informed clients. Typically, a major component of this strategy is an Open Banking initiative with APIs.

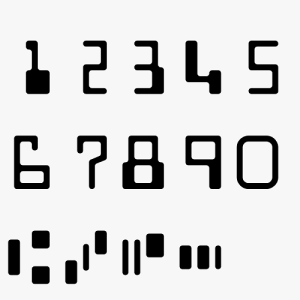

A nine-digit identifier called a routing number is used to identify a bank or credit union during a transaction. It intends to hasten and simplify banking industry operations. Each bank has been assigned a special number. Banks can still be easily identified from one another despite sharing identical names because to their distinctive routing numbers. This is why today I present the newfangled API that is Routing Number Bank Lookup API.

Ten or thirty years ago, automation in the banking industry may not have been an issue, but in the modern digital age, it is. By introducing open banking options, the banking sector is getting rid of its excessively onerous system and fulfilling customer expectations. The financial industry uses bank APIs as well to speed up and ensure reliable financial transactions. The Routing Transit Numbers APIs are a fantastic illustration of it.

A routing number, a nine-digit identity, is used during a transaction to identify a bank or credit union. It attempts to accelerate and simplify operations in the banking industry. Each bank has a certain number that has been assigned. Banks with the same names can nevertheless be identified from one another because to their unique routing numbers.

The database of a service can be linked, synced, and integrated with any application via application programming interfaces, or APIs. These serve as a bridge so that private and secure data flow can occur without the involvement of outside parties. To put it another way, APIs provide the integration tools necessary for creating the financial applications that clients will use.

The process of integrating these potent technologies into your business is not as difficult as it may seem. The majority of APIs have a protocol attached to each endpoint that outlines the required inputs and the output you will get API documentation typically includes instructions on how to successfully communicate with endpoints. The Routing Number Bank Lookup API, on the other hand, is a user-friendly bank information API that we recommend.

The incorporation of this API enables you to examine your provider’s routing number. Using this API, you can check the route transit number before making any transactions. Additionally, you can determine which bank the routing number belongs to. You will be able to determine the account’s location as a result. You can access the information about the bank. Additionally, by learning more about the bank, you’ll be able to contact them directly and double-check everything.

Your business will remain relevant in the age of digital banking by incorporating a banking API. Enhancing customer service, enabling secure transactions, and accepting ACH payments are all possible. The bank information APIs from Zyla Labs that are mentioned above are a great option for wire transfers.

Given the aforementioned details, Zyla Labs’ Routing Number Bank Lookup API is a fantastic addition to your business. By incorporating this bank information API, your business can maximize time and resources. To find a bank account and produce reliable financial transactions, you can automate the process of confirming routing numbers.