Understanding and negotiating the intricate web of economic factors in today’s interconnected global economy is critical for individuals, corporations, and politicians alike. Inflation rates are crucial among these factors, functioning as barometers of price stability and indications of economic health. Fortunately, with the advancement of new technology, access to up-to-date and accurate inflation statistics is now easier than ever. The Monetary Inflation Index API is one such powerful resource, allowing users to delve deep into the global economy and track inflation rates with precision and convenience.

A Monitoring API For Inflation Rates Allows For An In-Depth Examination Of The Global Economy

The following are the most popular use cases for this API:

- Economic Analysis: The API may use by researchers and economists to study monthly and yearly inflation rates, which are important indicators of a country’s economic health. This information aids in the evaluation of price stability, the efficiency of monetary policy, and the identification of possible dangers or opportunities.

- Monetary Policy Decision-Making: In order to make educated choices on interest rates, money supply, and other monetary policy measures, central banks and policymakers rely on reliable inflation statistics. The API gives access to inflation rates, supporting policymakers in developing and changing policies.

- Investment Strategy: In order to identify inflationary risks and alter their investment strategies, investors and financial institutions might include current inflation rates in their investment models. This information aids in asset allocation, portfolio management, and mitigating future inflationary losses.

- Inflation data is used by businesses across sectors to estimate price trends, alter pricing strategies, and forecast expenses. Companies may keep up to current on monthly and annual inflation rates by using the API, allowing them to make educated decisions about product pricing, budgeting, and resource allocation.

- Risk Management: Inflation has an influence on a company’s profitability and sustainability. The API may be used by risk managers to monitor inflation patterns and identify possible hazards connected with price volatility. This data assists in the development of appropriate risk-mitigation and hedging strategies for inflation-related issues.

Overall, the Monetary Inflation Index API is a strong tool for acquiring insights into the global economy, tracking inflation rates, and assisting decision-making in a variety of fields such as economics, finance, business, and risk management.

Which API Tracks Inflation Rates The Most Accurately?

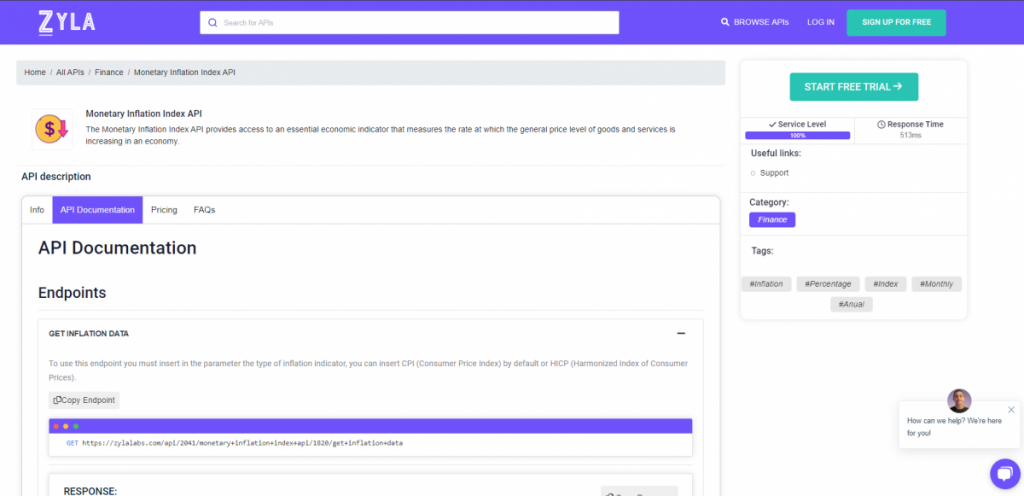

Following considerable testing, we can confidently state that the Zylalabs API is the easiest to use and gives the greatest results: Monetary Inflation Index API

In addition, the findings are provided in JSON format!

Entering CPI or HICP into the “Get Inflation Data” endpoint. For example, produces the following results:

[

{

"country": "The Netherlands",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 1.034,

"yearly_rate_pct": 5.175

},

{

"country": "Turkey",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 2.386,

"yearly_rate_pct": 43.684

},

{

"country": "United States",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.506,

"yearly_rate_pct": 4.93

}

]Where Can I Find This API For Tracking Inflation Rates?

- To begin, go to the Monetary Inflation Index API and press the “START FREE TRIAL” button.

- After joining Zyla API Hub, you will be able to utilize the API!

- Make use of the API endpoint.

- After that, by hitting the “test endpoint” button, you may perform an API call and see the results shown on the screen.

Related Post: What Are Economic Indicator APIs Used For?